Despite their seemingly similar nature, there are a lot of distinctions between these two practices; quite a few important ones, too. In this article, we’ll simply explain all of them—read on to find out everything about financial and managerial accounting. A Certified Management Accountant (CMA) practices managerial accounting, while a Certified Public Accountant (CPA) practices financial accounting. If you want to know how much that assembly machine is worth (its value) after two years in your production line, you make use of financial accounting to analyze the situation. Managerial accounting can help identify which products or services can generate the highest returns and which are underperforming.

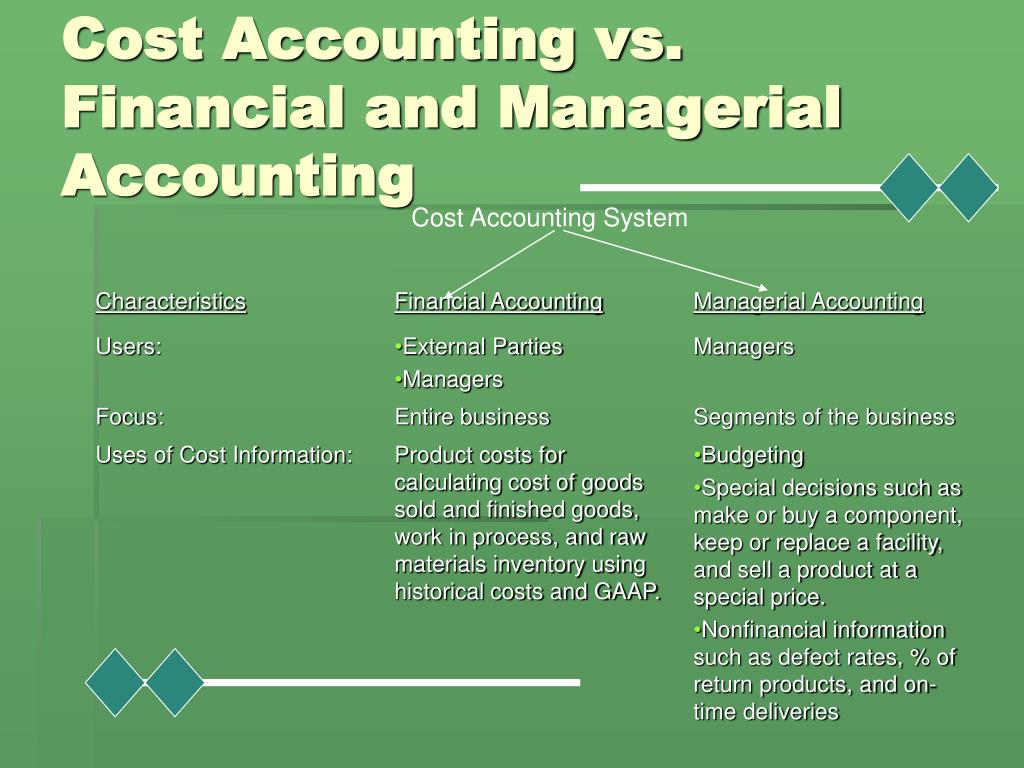

What is the difference between managerial and financial accounting with regard to users?

For instance, production managers are responsible for their specific area and the results within their division. Accordingly, these production managers need information about results achieved in their division, as well as individual results of departments within the division. The company can be broken into segments based on what managers need—for example, geographic location, product line, customer demographics (e.g., gender, age, race), or any of a variety of other divisions. In the world of business, information is power; stated simply, the more you know, typically, the better your decisions can be. Managerial accounting delivers data-driven feedback for these decisions that can assist in improving decision-making over the long term. Business managers can leverage this powerful tool in order to make their businesses more successful, because management accounting adds value to common business decision-making.

Key Differences Between Financial Accounting and Management Accounting

- Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more.

- Without this information, you are likely to make decisions based on incomplete or outdated data, which increases the chances of errors.

- In addition, financial accounting information is historical in nature, where financial accounting reports concentrate principally on the results of past decisions.

- Managerial accounting, also known as management accounting, is the process of generating financial information for internal use by management.

- This includes both direct costs, such as the cost of raw materials and labor, as well as indirect costs, such as overhead expenses.

After the accruals (which affect both the COGS and OPEX accounts), she prepares Primark’s Income Statement for a final review. Managerial accounting, as the name suggests, is primarily intended for business managers and other internal stakeholders. A crucial function is to keep expenses in check, as they are among the key growth drivers a business should analyze to succeed.

Managerial vs Financial Accounting

Investors are only interested in startups that have their finances in order and can present clear, reliable financial data. They want to ensure that their investments are managed wisely and that the startup has a solid plan for profitability. Budget is one of the most important concerns for startups, which makes it challenging to prioritize financial management, especially when resources are scarce. Without proper financial accounting, a startup would have inaccurate or incomplete records, which might overestimate the available cash flow or underestimate expenses.

Purpose of Reports

Financial accounting and managerial accounting (sometimes called management accounting) are quite different. While both these types of accounting deal with numbers, managerial accounting is strictly for internal use. Financial accounting, on the other hand, focuses primarily on the collection of accounting information to create financial statements. Financial accounting must conform to certain standards, such as generally accepted accounting principles (GAAP).

Managerial accounting can also be seen as a controlling framework because it monitors and regulates an organization’s activities to ensure it meets its objectives. It includes everything from setting performance standards to comparing them against actual outcomes so that any variances can be timely verified. This is necessary to ensure the management knows the reason for the decline in performance (if and when that’s the case) and what corrective 13 strategies to speed up collections measures they need to take. Financial accounting doesn’t just help you identify the right opportunities but also solves problems quickly. For instance, you can detect liquidity issues early on by regularly reviewing cash flow statements to see whether the expenses are consistently higher than revenue or not. Beyond investment decisions, financial data can also help decide whether to cut costs and pinpoint non-essential spending.

It is more concerned with the operational use of assets and how they can be best deployed to generate more revenue. Reports generated through managerial accounting are highly detailed and focus on a particular department or operational activity to provide data that can help managers improve overall internal performance. Managerial accounting is a forward-looking concept that focuses on future outcomes using current and historical data. It is primarily historical in nature, recording what has already happened by summarizing financial transactions that previously occurred during a specific period. It gets easier for a business to run its financial operations when they have the necessary data to manage day-to-day operations. Managerial accounting provides these tools and insights to help a business continuously monitor and analyze its financial performance.

So, in the end, it’s not about one being harder than the other but what you prefer – a structured, rule-based approach or dynamic and adaptable framework that purely focuses on decision-making. Detailed financial records can also help in comparing different areas of options to see where money is being lost. If one department consistently runs over budget, financial data can spot the exact expenses causing these issues.

Financial accountants produce financial statements based on the accounting standards in a given jurisdiction. Similar job titles include cost accountant, private accountant, corporate accountant, management accountant and industrial accountant. These positions monitor the company’s financial accounts and provide managers information to support business decisions. The two primary responsibilities of accountants — whether they work as employees or outside consultants — are managerial accounting and financial accounting. Students preparing for a career in accounting need to understand the distinct functions of managerial accounting vs. financial accounting, as well as the characteristics that the two share. Financial accounting is a branch of accounting that focuses on the preparation of financial statements for external users, such as investors, creditors, and regulators.

Leave a Reply